Calculate my retirement income

If you rely exclusively on. Your Federal income tax will be.

Average Retirement Income Where Do You Stand

Both the mean and median retirement income numbers above might seem above average relatively healthy.

. Detailed Analysis 15 questions about 15 minutes Use this version if you want to enter more details about your personal situation and retirement investments. 10 of your taxable income. Your Federal income tax will be.

This worksheet can help you estimate your total retirement income from various sources. You can print the results for future reference. Henrik earns 65000 per year in salary.

Including a non-working spouse in your. Retirement can be the happiest day of your life. You can use this calculator to help you see where you stand in relation to your retirement goal and map out different paths to reach your target.

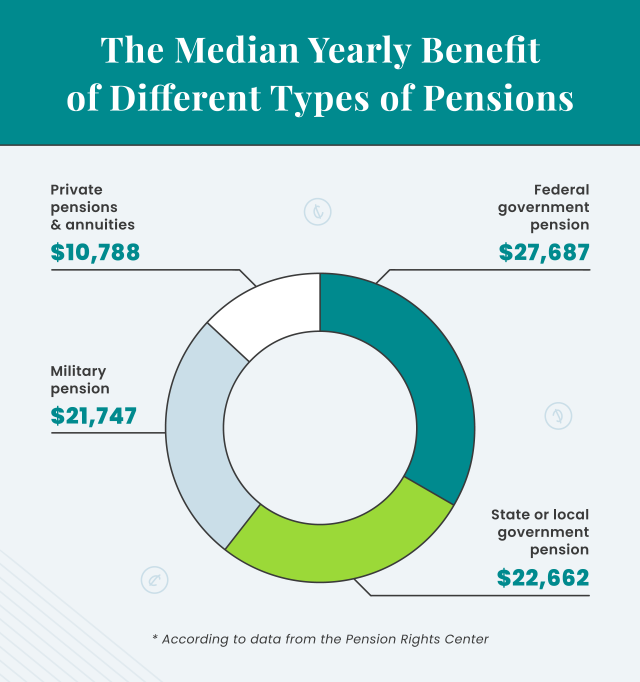

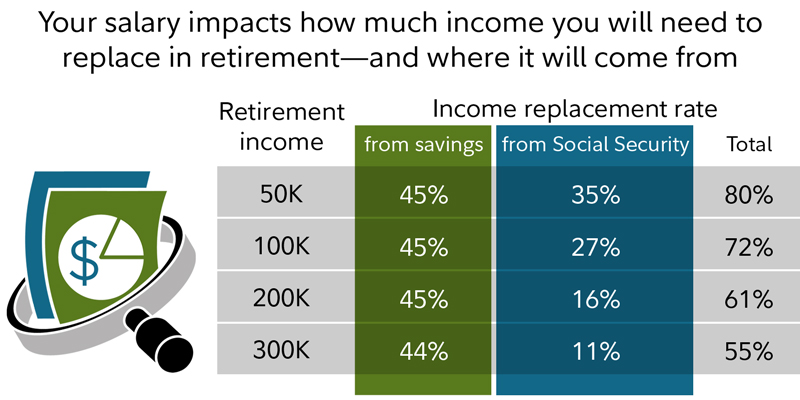

If you and your husband receive 2000 a month from Social Security or 24000 a year you need about 16000 a year from your savings. A Defined-Benefit Pension is designed to provide a specified amount of monthly income after retirement. If your annual pre-retirement expenses are 50000 for example you want a pension income of 40000 if you follow the 80 percent rule.

Statements for other savings that will provide ongoing monthly retirement income annuities foreign pensions. You usually must start receiving pension payments when you reach age 65 or the normal retirement age set by your employer. It is filled out using the example of Henrik who is planning for his retirement.

Refer to IRS Publication 17 for a more detailed coverage of gross income items and what is considered to be taxable for your particular situation. Estimate income from pensions and annuities IRA and 401k distributions and Social Security income using prior year taxable amounts. Use this version for a quick look at your retirement outlook.

10 of your. You can use an income tax calculator online to quickly understand your tax liabilityThe income tax calculator is a simple tool that gets updated with the latest rules and regulations and shows you your accurate income tax liability for the yearTo understand how much income tax you need to pay for the financial year ending on 31 st March 2022 use our. The worksheet assumes that youll need to replace about 80 percent of your pre-retirement income.

Your retirement is on the horizon but how far away. Add in taxable retirement income if applicable. To use this calculator you must have access to a modern Web browser.

If a business pays its employees once a week then you would have 52 pay periods in a year. Average Retirement Income 2022 by Household Age Incomes Drop Dramatically for the Oldest Surveyed. You can shift money from a traditional individual retirement account IRA or 401k into a Roth IRA by doing a Roth IRA conversion.

Its best for those who dont have a lot of different investments. An account owner who delays the first RMD will have to take two distributions in one year. How to calculate gross pay for salaried employees.

If you are 55 or older you can withdraw from your 401k or other employer-sponsored plan if you have separated from service that is you are no longer at your job. To calculate gross pay for a salaried employee take their total annual salary and divide it by the number of pay periods within the year. Should I convert discretionary expenses to savings.

An eligible household member is anyone who needs to file a tax returnFor example say that you have 20000 in eligible income your husband has 40000 and your household has 5000 in eligible deductions. The chart extends to age 95. This chart shows a projection based on the savings and growth you plan and a withdrawal of your desired annual retirement income during retirement.

For 2020 look at line 10 of your Form 1040 to find your taxable income. However these numbers dont tell the whole story. View your retirement savings balance and calculate your withdrawals for each year.

Keep in mind this is an estimate and you may need. You may be able to start receiving payments as. The easiest way to calculate your tax bracket in retirement is to look at last years tax return.

Im retired how long will my savings last. How much retirement income may my 401k provide. This leaves approximately 40 percent to be replaced by retirement savings.

Annual salarynumber of pay periods gross pay per pay period. Are my current retirement savings sufficient. Nor do they reflect the retirement crisis that is so often reported.

Social Security retirement benefits should replace about 40 percent of an average wage earners income after retiring. How does inflation impact my retirement income needs. Canadas income tax system uses the following two methods to calculate the tax payable on Canadian-source income you receive.

When should I begin saving for retirement. Social security retirement income estimator. Social Security income is generally taxable at the federal level though whether or not you have to pay taxes on your Social Security benefits depends on your income level.

This pre-retirement calculator was developed to help you determine how well you have prepared and what you can do to improve your retirement outlook. If you had a transfer or rollover to your Schwab retirement accounts a conversion from a traditional IRA to a Roth IRA and back or any correction for security price after year-end please call us at 877-298-8010 so we can recalculate your RMD. The example shows Henriks retirement income based on the following assumptions.

This monthly income is a percentage of your salary during working life. If you are a married joint filer and your income is. Henriks retirement income.

Microsoft Edge version 85 or newer Mozilla Firefox version 68 or newer Safari version 1312 or newer. The RMD is taxed as ordinary income with a top tax rate of 37 for 2021 and 2022. Survivor pensions etc Notes.

Retirement Savings Calculator Am I saving enough for my retirement. If you do a Roth IRA conversion youll owe income tax on the. Social security is calculated on a sliding scale based on your income.

To figure your annual household income sum the modified adjusted gross income for all eligible household members. The light blue area shows a possible net worth range based on your savings and a growth rate range of 4 to 12 before retirement and 2 to 6 during retirement. Method 1 Non-resident tax Canadian financial institutions and other payers have to withhold non-resident tax at a rate of 25 on certain types of Canadian-source income they pay or credit to you as a non-resident.

If you have other sources of retirement income such as a 401k or a part-time job then you should expect to pay some income taxes on your Social Security benefits.

How Early Retirement Reduces Projected Social Security Benefits

Fidelity S Retirement Calculators Can Help You Plan Your Retirement Income Savings And Assess Your Financial Health Fidelity

What Will My Savings Cover In Retirement Fidelity

I Built A Spreadsheet To Calculate What It Would Take To Retire Early And It Was A Shock

The 10 Best Retirement Calculators Newretirement

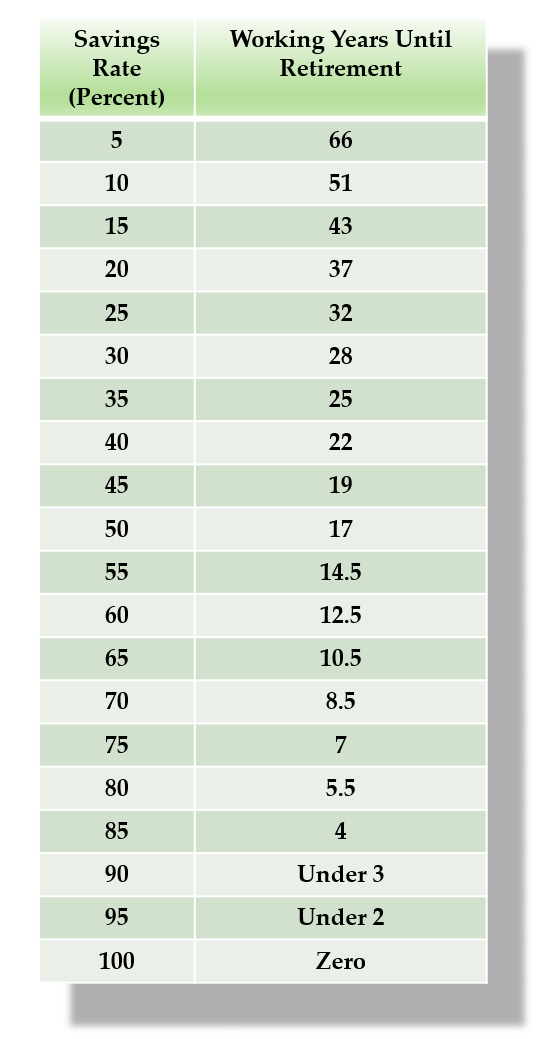

The Shockingly Simple Math Behind Early Retirement Mr Money Mustache

The 10 Best Retirement Calculators Newretirement

Estimate Your Benefits Arizona State Retirement System

What Will My Savings Cover In Retirement Fidelity

I Built A Spreadsheet To Calculate What It Would Take To Retire Early And It Was A Shock

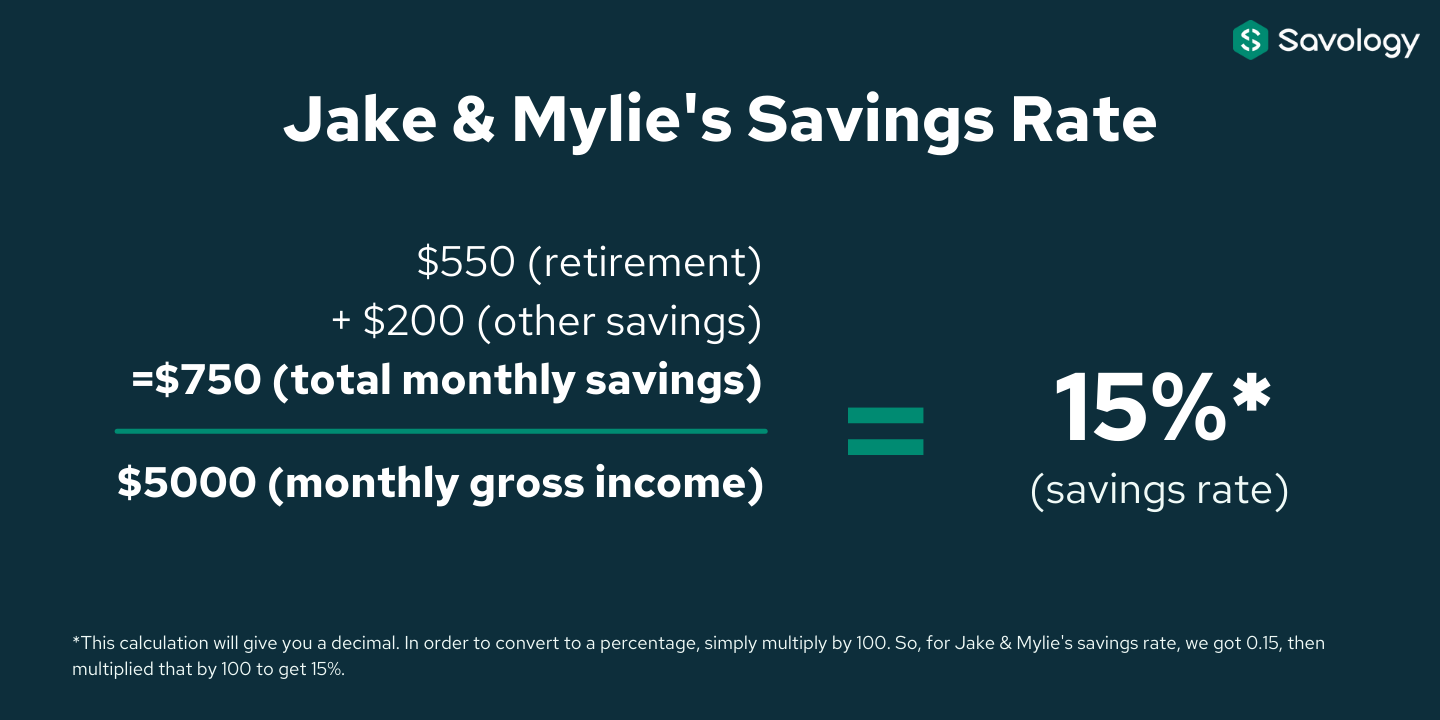

Savings Rate 101 What It Is And How To Calculate It Savology

Free 401k Calculator For Excel Calculate Your 401k Savings

The 10 Best Retirement Calculators Newretirement

Fire Calculator When Can I Retire Early Engaging Data

The Ultimate Guide To Calculating Your Retirement Savings Synchrony Bank

The 10 Best Retirement Calculators Newretirement

Net Worth Calculator Find Your Net Worth Nerdwallet